Find the Essential:

Access our latest quarterly report with the financial and operational results.

Download PDFLearn about our business through our corporate presentation.

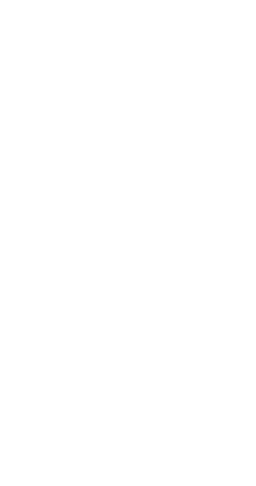

Download PDFPortfolio of high-quality properties located in Mexico's main real estate markets

Transparent Reporting

Review Fibra MTY’s performance, including key operational and financial indicators for the most recent quarter.

Stabilized Property Portfolio

Each investment is evaluated based on location quality, construction standards, tenant profile, and lease fundamentals.

Institutional Trust

As a company listed on the Mexican Stock Exchange, Fibra Mty is highly regulated, offering its investors accurate and consistent information.

Consistent Returns

Fibra Mty is the only issuer on the Mexican Stock Exchange to distribute cash monthly. Distributions are generated from lease contracts that are predominantly U.S. dollar-denominated, inflation-indexed, and entered into with high-quality tenants.

Financial Strength

Competitive returns with prudent use of financing sources. Financial flexibility to capture opportunities.

What is Fibra Mty?

Company recognized for raising the standard in the Mexican real estate market

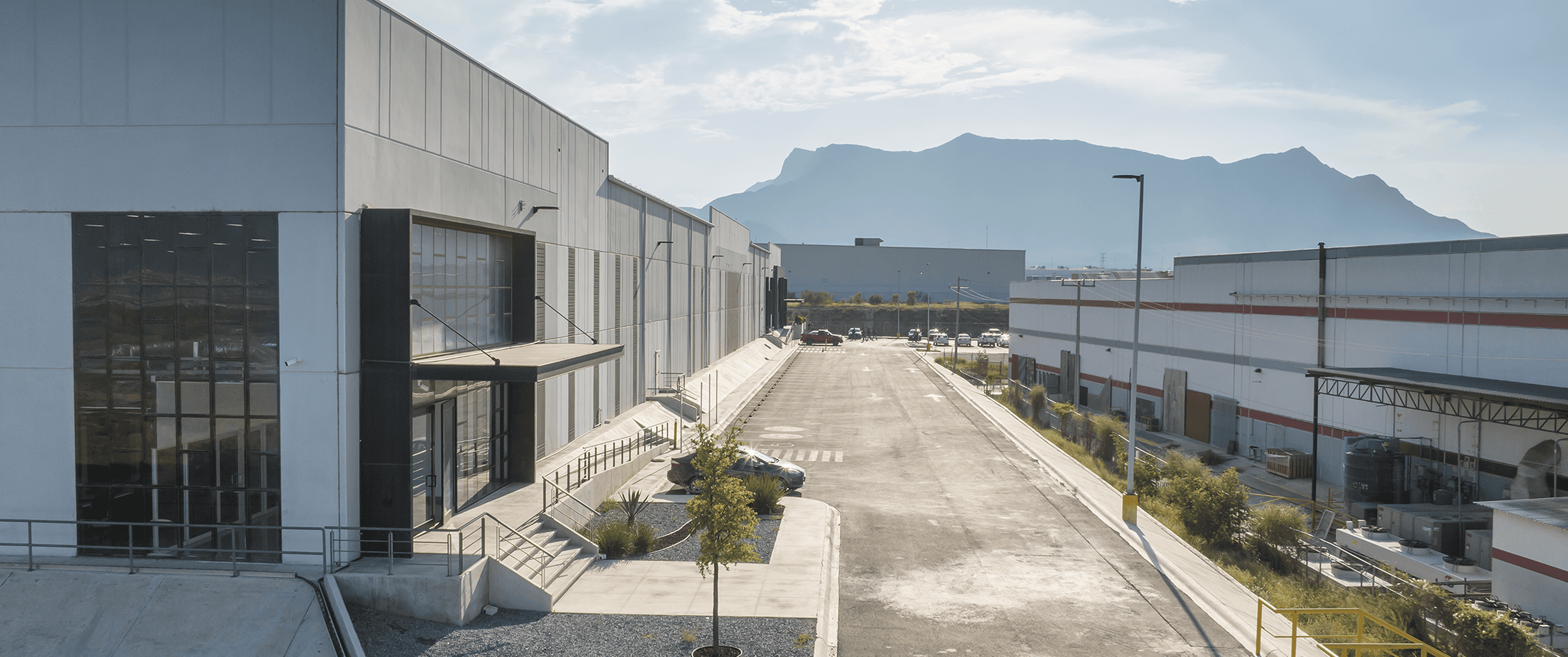

Fibra Mty offers returns from high-quality properties in strategic locations managed by professionals with extensive experience in the sector.

About Fibra Mty

More than 10 years of generating value for our investors.

Monthly Distributions

Receive monthly cash distributions, comparable to direct real estate ownership, with enhanced liquidity and diversification.

Access to Appreciation

Trade based on your investment objectives and liquidity needs.

Investment in High-Quality Properties

More than 100 properties with +1.8 million m² in strategic locations and a wide variety of tenants and economic sectors.

Business model

Aligned Corporate Governance

Fibra MTY’s corporate governance framework is designed in accordance with best corporate governance practices and international standards, incorporating an independent Technical Committee and an independent Manager. Our Technical Committee operates under an open and transparent governance structure, commonly referred to as a non-staggered board, with no management incentives beyond those aligned with investor interests. The Committee upholds high standards of transparency and integrity across the Company’s operations and business practices.

Balanced Capital Structure

At Fibra Mty, we believe that an appropriate balance between equity issuance and debt is essential to achieving sustainable growth and long-term value creation for our investors. We maintain a solid credit profile and a balanced leverage structure that allows us to access competitive financing costs while preserving flexibility to pursue growth opportunities. Our objective is to maintain a Net Debt to EBITDA ratio below 3.5x and an interest coverage ratio above 3.0x, ensuring a robust financial structure and long-term stability.

High-Quality Real Estate Portfolio

The properties within our portfolio are distinguished by their prime locations, tenant diversification, strong lease agreements, high rent collection rates, which together support stable and predictable cash flows. At Fibra MTY, portfolio growth and diversification are strategically focused on enhancing the competitiveness and long-term value proposition for both our tenants and investors.

Disciplined Growth Strategy

At Fibra Mty, we define an investment as value-accretive to CBFIs when it offers stable rental cash flows, strategic locations with appreciation potential, and identifiable opportunities for operational optimization. Through rigorous market analysis and the application of sustainability principles and sound corporate governance practices, we identify investments that allow us to expand our portfolio and continue generating long-term value. We remain committed to innovation and operational efficiency as key drivers of sustained competitiveness and growth.

Total Properties

0+

Million m² (GLA)

0.0M

Occupancy Rate

0.0%

USD-denominated rents

0.0%

A high-quality portfolio located in Mexico's main markets

Quick guide to investing

Open an Account with a Brokerage Firm

Choose the platform that best suits your needs and complete your registration.

Buy Real Estate Trust Certificates (CBFIs)

Find Fibra Mty on the stock market and purchase the desired number of CBFIs.

Receive Monthly Distributions

Generate recurring passive cash flows from our real estate portfolio.

Monitor your Investment

Review financial reports and the performance of your investment in real time.